Solmar St. Pete OZ Fund Overview

The Solmar St. Pete OZ Fund is a single asset QOF that will build a Class A luxury high-rise apartment building in prime Downtown St. Petersburg, offering a rare combination of high-end real estate with powerful tax advantages. With a target raise of $30 million in OZ equity, the $121 million project is projected to deliver to investors a 20%+ after-tax IRR and a 3.49x MOIC. In addition to deferring and potentially eliminating future capital gains, investors benefit from significant bonus depreciation tax losses with no recapture.

Fund Overview

- Target Capital Raise: $30M in OZ investments

- Minimum Investment Amount: $250,000

- Accredited investors only

- Projected Return: ~20%+ IRR

What Makes Downtown St. Pete an Ideal Location

Downtown St. Pete is supply constrained by highways on three sides, and the ocean on the east. There are very limited development sites

left in this highly sought after neighborhood. Solmar St. Pete is just two blocks from Central Ave, the main commercial corridor. It is within walking distance to restaurants, shopping, entertainment, parks, museums and waterfront attractions. Downtown St. Pete is close to multiple employment hubs in tech,

defense, logistics, finance and healthcare. Strong rents with continued population growth should continue to

drive significant real estate value. Ranked #1 Beach in the US with an average annual temperature of 83F, St Pete offers a great lifestyle for residents.

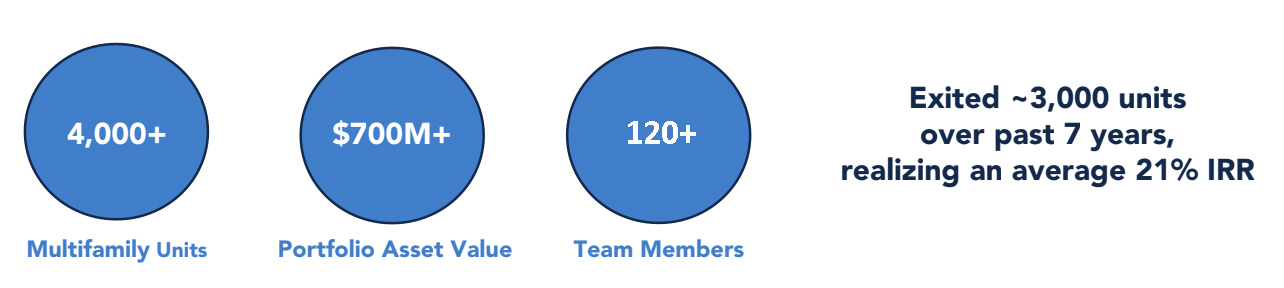

Our Track Record

Sinatra & Co. Real Estate is a privately held, vertically integrated real estate firm headquartered in Buffalo, New York. With a proven track record in fund and asset management, Sinatra & Co. currently manages more than $700 million

in real estate assets, including over 4,000 multifamily units throughout New York, Florida, and Illinois. The firm’s disciplined investment strategy, combined with its commitment to long-term value creation, has earned the trust of a

diverse and sophisticated investor base.

Contact us to learn more or to request fund materials.