As a fully integrated platform, Sinatra & Co. oversees all aspects of the investment lifecycle from acquisition and development to property management and disposition. Its experienced team drives performance through rigorous underwriting, strategic market selection, and hands-on operational oversight. While multifamily remains the firm’s core focus, Sinatra & Co. continues to pursue synergistic opportunities in mixed-use redevelopment, urban revitalization, and rehabilitative development. The firm is guided by a people-first philosophy, seeking not only to deliver strong financial returns but also to create lasting impact in the communities it serves.

FUND OVERVIEW FOR ACCREDITED INVESTORS

- Minimum Investment Amount: $50,000

- Term: 5 Years plus (2) 1-year Optional Extensions

- Target Return: 10% Annual - Paid Monthly

- Guarantor: Nick Sinatra, Personal Guarantor

- Investments: Portfolio Loans to Affiliate Borrowers

- Who can invest: 25% of Fund Allocated for Qualified Plans

FUND OVERVIEW FOR QUALIFIED PURCHASERS

- Minimum Investment Amount: $500,000

- Term: 5 Years plus (2) 1-year Optional Extensions

- Target Return: 12% Annual - Paid Monthly

- Guarantor: Nick Sinatra, Personal Guarantor

- Investments: Portfolio Loans to Affiliate Borrowers

- Who can invest: 25% of Fund Allocated for Qualified Plans

Why a Notes Fund?

Gain a Competitive Edge

Affordable capital to deploy into affiliated assets and acquisitions will help us increase operational efficiency.

Operational Efficiency

The Fund should help Affiliate Borrowers to be more efficient at acquiring, managing, operating, holding, and selling institutional grade, Class A and Class B multi-family properties.

Reduce Cost of Capital

The Fund will seek to provide Affiliate Borrowers with capital at a lower cost than they could obtain from traditional financing sources.

Efficient and affordable capital

will help grow the firm into a world-class operator

Markets of Interest

Interested in growing our portfolio in Florida. Secondary markets of interest include Texas, Indiana, Ohio, Kentucky, Tennessee, North and South Carolina, and Georgia.

- High Demand for Workforce Housing

97+% occupancy in target markets for the workforce rental segment with no new supply to meet this demand. - Business-Friendly

Entrepreneurs and corporations are relocating to these regions given tax and policy incentives. - Favorable Fundamentals

High demand and growth markets according to multiple commercial real estate publications. - Value-Add Opportunities

Outdated housing stock and population migration will fuel value-add multifamily opportunities.

Our Track Record

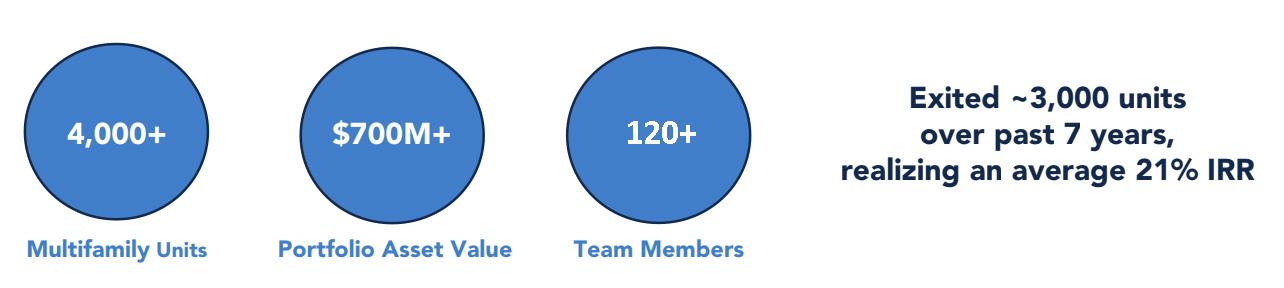

Sinatra & Co. Real Estate is a privately held, vertically integrated real estate firm headquartered in Buffalo, New York. With a proven track record in fund and asset management, Sinatra & Co. currently manages more than $700 million

in real estate assets, including over 4,000 multifamily units throughout New York, Florida, and Illinois. The firm’s disciplined investment strategy, combined with its commitment to long-term value creation, has earned the trust of a

diverse and sophisticated investor base.

Contact us to learn more or to request fund materials.